Theory of gaps explained

When there is a price difference between the two consecutive days, high and low, a gap is said to have created in the chart. Gaps are of two types-

1. Positive gaps or Bullish gap

2. Negative gap or Bearish gap

If today’s low is higher than yesterday’s high, a positive gap is created. On the other hand, if today’s high is lower than yesterday’s low, a negative gap is created.

Any news or information that comes after the market hours influences the trader causing them to be either optimistic or pessimistic as the case may be which results in excessive demand or supply and accordingly a gap occurs. A positive gap is result of positive news and a negative gap is a result of negative news.

Gap is caused either due to over-optimism or over-pessimism which does not stay longer and the trader get back to the normal mental condition and accordingly the gap gets filled up. It is said that gap gets filled, but its not necessary that they have to be filled.

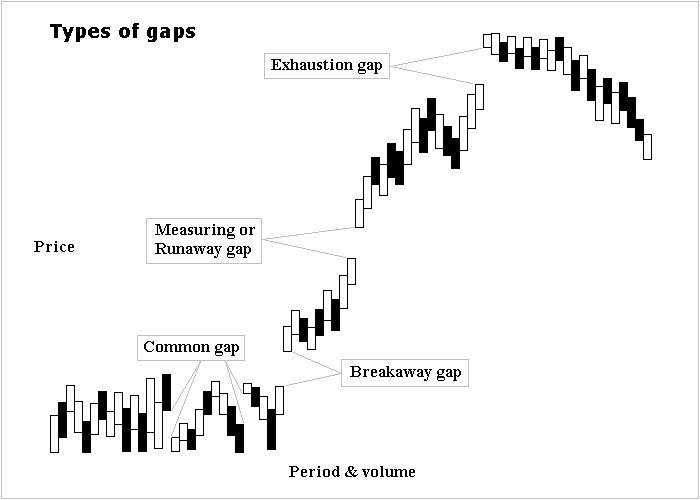

According to the place of occurrence, gaps are classified into 4 categories. They are as follows-

1. Common Area gap

This type of gaps occurs when the market is in choppy trend. These types of gaps are very small in nature and they soon get filled up. These types of gaps do not have any technical significance. Crowd becomes unnecessarily over enthusiastic and accordingly these gaps occur. As the market is in a range bound zone, the gaps cannot take the prices beyond the extreme levels and prices are still confined within the zone. Hence these gaps do not bear any significance to take a note of. So a common area gap can easily be disregarded.

2. Breakout gap

When the price comes out of a congestion with a gap, it is known as breakout gap. A breakout gap occurs with heavy volumes and normally this gap does not get filled very quickly. Price is in new horizon and wants to move ahead only. We can say that breakout gap is the starting point of a sustained move.

3. Runaway gap

Any gaps which occurs in the direction of the trend is known as runaway gap. This gap tells us that still there is a fuel in the journey and the price is not yet exhausted. A runaway gap is also known as measuring gaps because it can measure the extent of the next movement. Measure the distance between the breakout gap and the runaway gap and project the same distance ahead to get the target of the movement. Let us note that there could be more than one runaway gap in the same direction.

4. Exhaustion gap

If breakout gap is the starting point of the journey then exhaustion gap is the end of the journey. We should be careful about the exhaustion gap as it marks the end of a trend. Any gap which is getting filled up within three days is called exhaustion gap. To conclude , n exhaustion gap is the end of the movement.

Tag:gaps, Technical analysis

2 Comments

Make a more new posts please 🙂

___

Sanny