How does psychology play a role in Stock market?

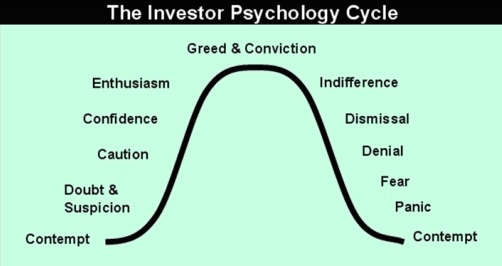

Psychology drives the market. Stock market on a broader view is driven by two psychological factors known as hope or greed and fear. The most interesting aspect is that people want to buy more and more as the price goes up. It happens because price creates a dream in the mind of the people and they could not resist but jumps to buy. No rational thinking, no logical behavior can stop them.

Role of Greed in Stock market

People become irrational and start thinking that price will go higher and they will make quick money. Another interesting aspect is that as long as the price doesn’t starts rising over to a particular zone, nobody is interested.

Normally the buyers are not interested to buy at this junction but once price starts rising, it creates a dream in their mind and more the prices goes up more and more the buyer joins. So there is a direct correlation between the price going up and the greed of the people going up.

Role of Fear in Stock market

On the contrary, when the price starts falling people become nervous and think that the price will go further deep and deep, so it’s better to get out and thereby they sell the share at the throwaway prices. This suggests that when the price starts going down fear takes over in the mind of the people and in most cases they sell the share at the rock bottom prices which is called panic bottom.

Once this panic bottom is created in the market, it implies that the worst is over and price then make U-turn to go up. Hence most of the common public they buy at a higher price out of greed and sell at a lower price out of fear. This is called trading on temptations.

Crowd psychology

This greater number of people who somehow or the other keeps on losing money is called the crowd. To define a crowd we can say when more than one people assemble together for a common purpose. Another interesting phenomenon is that people in the market always wants to talk about market with their fellow people.

Wall Street research on crowd behavior

A research was made in the Wall Street in 1992 and it was found that 95% of the people is looser and the reason for the same was investigated which came out as a report that it is lack of knowledge. The most normal culture in the market is to ask others about what they feel. So people here always feel that other is more knowledgeable than himself.

Hence they want to exchange their opinion. But ironically the person forgets that the other man to whom he asked about the market view is nobody but the member of this 95%.Hence, it is said that market is a battlefield between the crowd and the smart people.

Bottom-line

In stock market, money keeps on rotating between the weak hands to strong hands. Another interesting fact is that every time the trader makes a mistake and promises not to repeat the same mistake once again. But the problem is that the mistakes made by the trader earlier will be repeated again and again.

3 Comments

Make a more new posts please 🙂

___

Sanny